A recent survey released data on worldwide customer behaviour based on footfall data during these lockdown months. The data has shown some interesting insight into the changes experienced within the retail sector by country.

Retail Sales

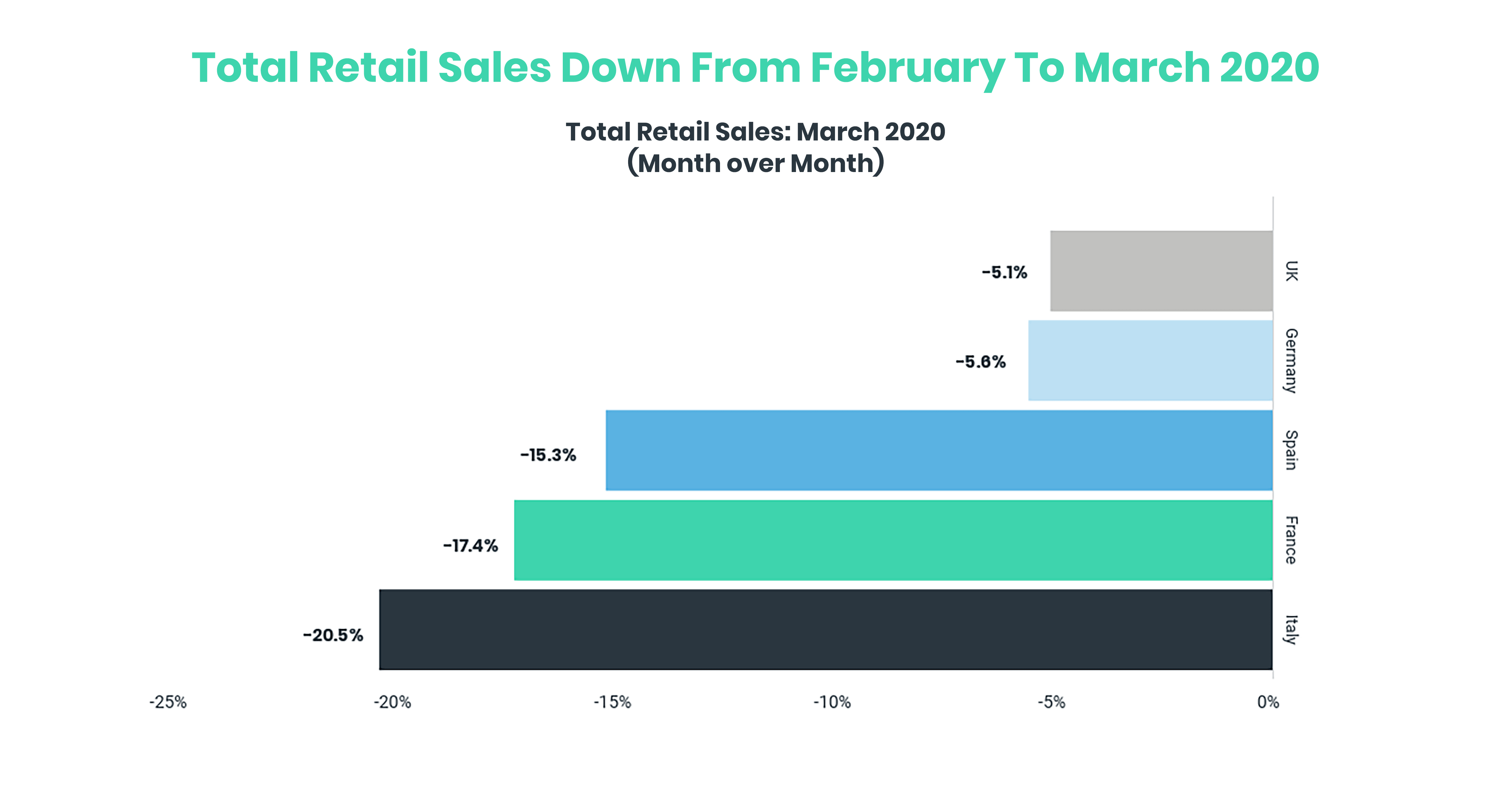

Overall the retail sector has seen a substantial drop in sales, in particular between February and March when lockdown regulations were initiated across Europe. Italy faced the most substantial drop of 20.5%, whereas the UK only faced a 5.1% drop. The difference in these figures could be attributed to Italy being further ahead in the pandemic and facing much stricter lockdown regulations. However, after each country was officially notified by their government to enter lockdown, they took substantial drops in sales and store footfall plummeted.

Footfall Traffic

When looking at footfall traffic data across stores in Europe, it demonstrated some discrepancies between the various countries and how customer behaviour differed between each one. In Italy for example, the data showed the pubic was more cautious earlier on and didn’t wait for lockdown regulations to limit their store visits. Traffic trends showed that there was a 40% drop on February 23rd ahead of lockdown, when there were only 150 cases reported. When lockdown was officially initiated, footfall drop 75% compared to the prior year and 4 days later nearly hitting a 100% drop. The figures show the Italian market to be extremely cautious with individuals limiting store visits unless absolutely necessary.

In comparison, store traffic in the UK only started to decline once the government issued a high-risk warning, with a decline of 15% compared to the previous year. There was then a continued further decline in alignment with government regulations until a bottom of around -80%. The figures demonstrated that the UK general public began to limit shopping once risk levels become higher.

Shopping Patterns

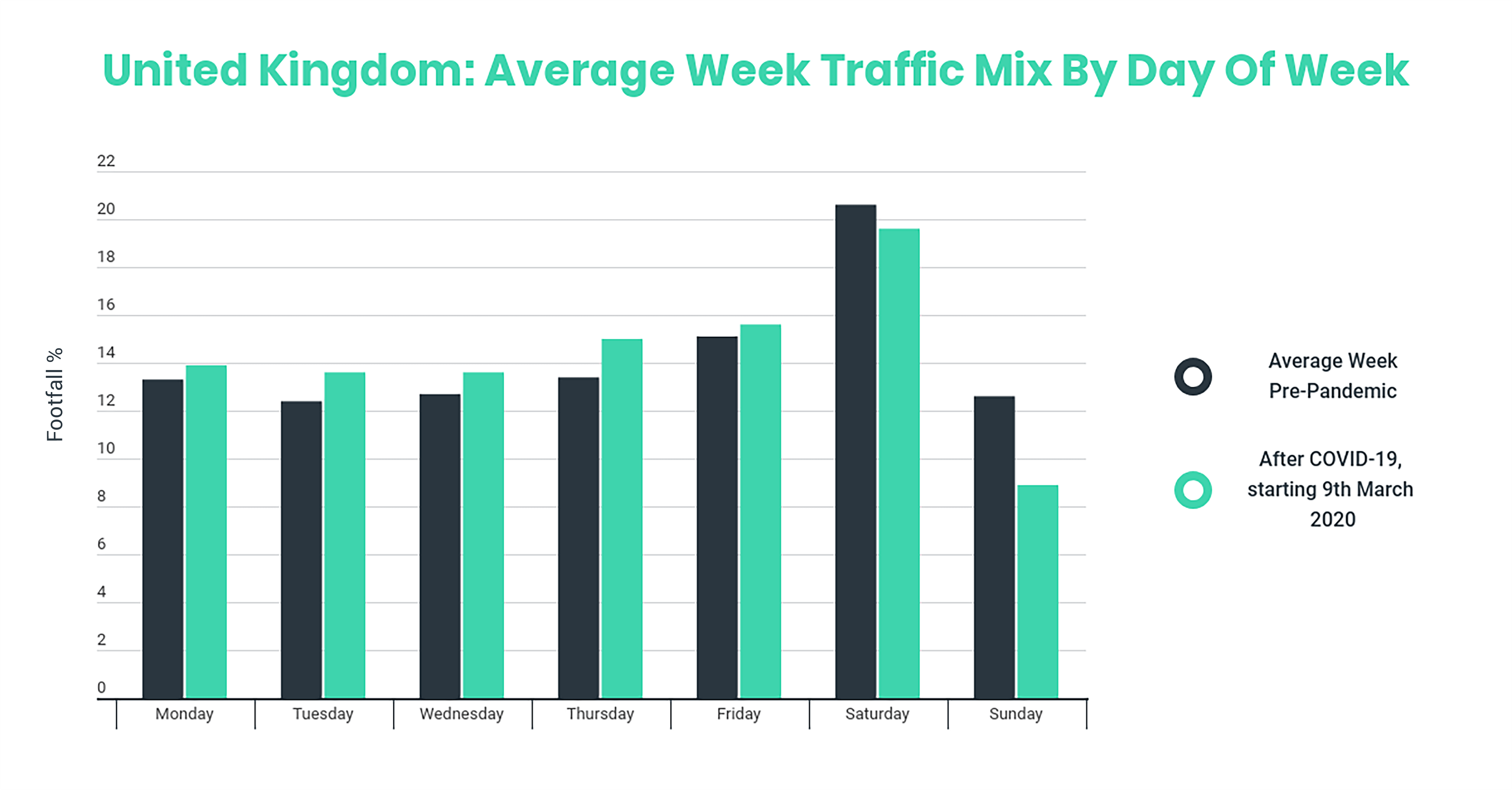

Pre-pandemic, weekend traffic accounted for 48% of weekly shopper traffic, but since lockdown started shoppers have taken to shopping more frequently on a weekday instead. Since March 21st, daily traffic levels have flattened, resulting in a higher weekday mix of 56%. These changes can be observed as shoppers trying to avoid conceived busier times. Alongside this, the majority of the population is now working from home so there is greater flexibility over the times they are able to shop.

Supply-Chain Impacts

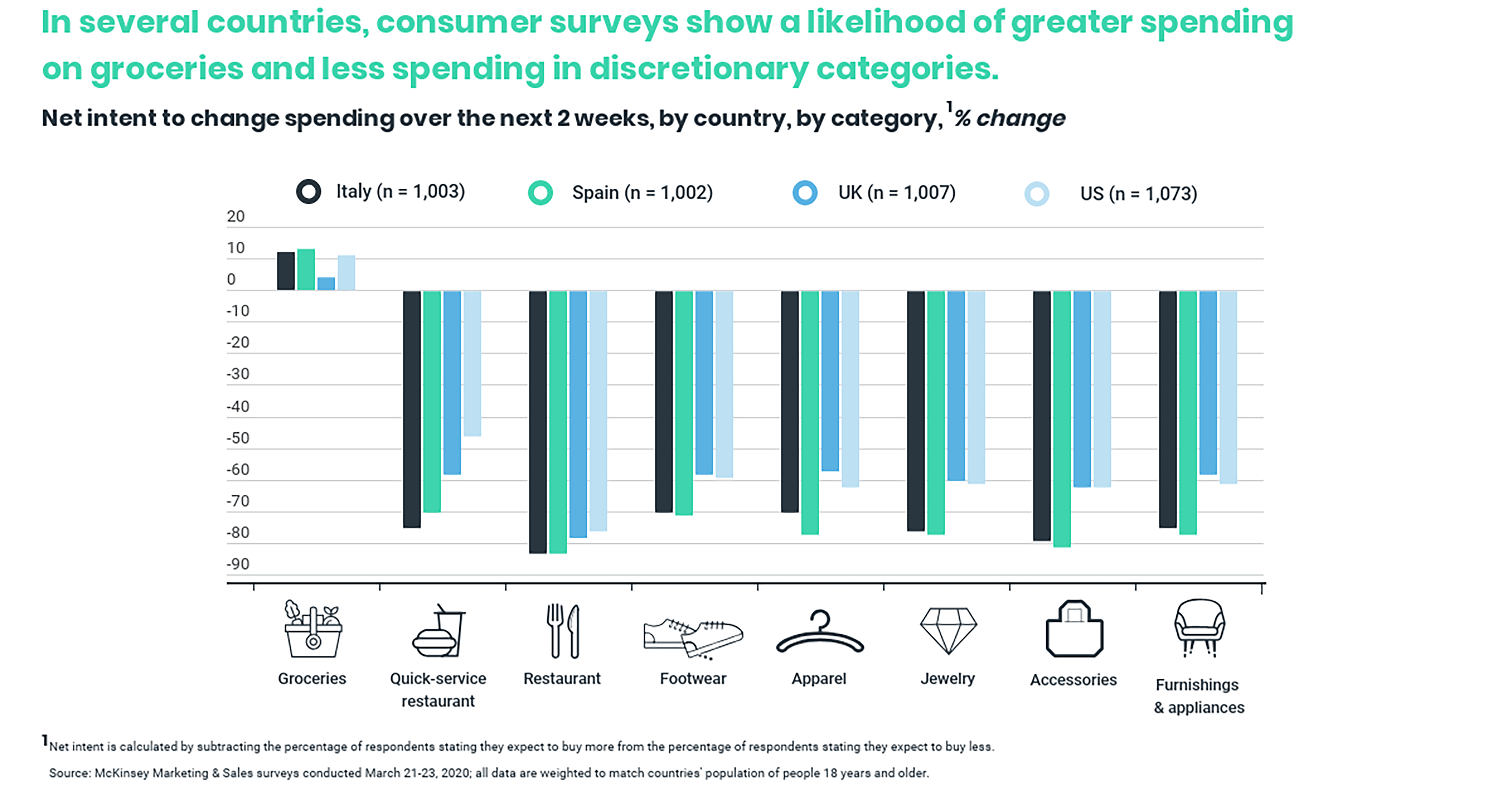

The changes to customer spending during the outbreak have led to a ripple effect on retailers’ entire supply chain. One noteworthy shift has been an abrupt swing in purchasing patterns, sales of nondiscretionary products such as food and personal items have spiked whereas discretionary items has experienced a drop. Consumer research conducted by Mckinsey indicates that these initial shifts could persist in the very near term though government choices might further influence consumer behaviour.

The research also indicated that respondents across the various locations were all expected to increase their online spending for a wide variety of items. Many stores and logistics systems were not prepared for the rapid shifts in demand patterns that we are currently experiencing. Retailers are having to rapidly adapt to retooling every aspect of their supply chain, continuously trying to balance the surge in demand in nondiscretionary goods whilst prioritising employee safety,

The ‘New Normal’

Sales and footfall are slowing beginning to increase back to pre-lockdown levels but there is still going to major changes to a customer’s shopping experience, due to social distancing measure, health & safety rules and occupancy restrictions. Consumer confidence will need to be rebuilt over time and it is important for retailers to consider what changes they can implement to make their customers feel safe. Technological implementations can help retailers streamline their operations, whether that’s store, or warehouse based to give them greater control over their occupancy levels, cleaning schedules and logistics operations.

When customers habits have changed drastically, in particular the increase in their weekly food shop has been causing stock shortages in stores. Technology has the potential to produce accurate information of shelf availability, so they better prepare further down the supply chain.

In addition, data-driven decisions based on footfall insight or spending trends can help you make the effective changes that will ensure your customer feels safe by limiting the number of individuals at one time, building their confidence to start shopping in-store again.